History of MicroStrategy: MicroStrategy’s Bets From BI to Bitcoin Pioneer (NASDAQ:MSTR)

MicroStrategy’s journey from a business intelligence innovator to one of the world’s most prominent Bitcoin holders is a saga of risk-taking, reinvention, and relentless ambition. Over three decades, the company has gone from being a respected—if relatively niche—provider of enterprise software, to a household name among crypto investors, thanks to its historic Bitcoin acquisitions and bold CEO leadership.

The Early Years: Building a BI Powerhouse

Founded in 1989 by Michael Saylor and Sanju Bansal, MicroStrategy was an early player in the business intelligence (BI) software industry. The company’s first decade was marked by the development of data analytics solutions for large enterprises. MicroStrategy’s flagship product, a BI platform for querying and visualizing enterprise data, attracted high-profile clients across retail, healthcare, and financial services.

In 1998, MicroStrategy went public on the NASDAQ under the ticker (NASDAQ:MSTR), riding the late-90s tech boom. The company’s shares soared during the dot-com bubble, but by 2000, a financial restatement sent the stock tumbling, putting the company’s survival in jeopardy. Michael Saylor, the company’s charismatic founder and CEO, weathered the storm, steering MicroStrategy back to stability with new products and a renewed focus on enterprise analytics.

The Business Intelligence Era

Through the 2000s and 2010s, MicroStrategy continued to develop and refine its BI platform. The company differentiated itself with a focus on security, scalability, and powerful analytics. It competed with tech giants such as IBM, SAP, and Oracle, carving out a niche among Fortune 500 customers seeking robust reporting and data visualization.

Despite this, MicroStrategy was rarely the biggest name in BI. Growth was steady but not explosive. The company faced pressure from new entrants and shifting technology trends, including the rise of cloud-based analytics platforms. Still, MicroStrategy remained profitable and cash-flow positive, with a conservative balance sheet that would later play a critical role in its transformation.

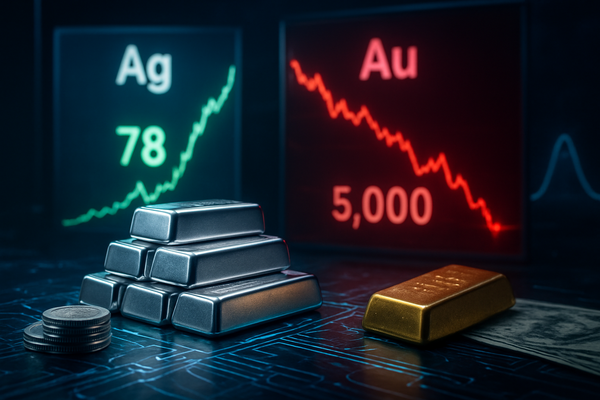

2020: The Bitcoin Bet that Changed Everything

MicroStrategy’s leap from enterprise software to Bitcoin pioneer began in 2020. Amid the economic uncertainty of the pandemic, CEO Michael Saylor—still at the helm after three decades—publicly voiced his concerns about inflation and the erosion of cash value. Instead of following the typical path of buying back shares or issuing dividends, Saylor announced MicroStrategy would convert a significant portion of its corporate treasury into Bitcoin.

Between August and December 2020, MicroStrategy bought over $1 billion in Bitcoin, making it the first publicly traded company to adopt Bitcoin as its primary reserve asset. The company funded additional purchases through convertible debt offerings, multiplying its holdings and setting off a wave of corporate Bitcoin adoption. Saylor became a vocal proponent of Bitcoin, positioning MicroStrategy not just as a software firm, but as a de facto Bitcoin investment vehicle.

Transformation and Volatility

MicroStrategy’s Bitcoin strategy drew intense media attention and controversy. The company’s market value became tightly correlated with the price of Bitcoin, causing wild swings in the stock price. Traditional investors, once attracted by the company’s stable enterprise software business, found themselves holding shares in a business with massive crypto exposure.

Nevertheless, Saylor doubled down, arguing that Bitcoin offered better long-term risk-adjusted returns than cash or bonds. The company continued to purchase Bitcoin at regular intervals, ultimately amassing one of the largest corporate Bitcoin treasuries in the world—totaling more than 200,000 BTC by mid-2025.

MicroStrategy’s core software business, meanwhile, remained operational, though overshadowed by the company’s high-profile cryptocurrency strategy. Software revenues were steady, but growth was modest compared to the potential windfalls—or losses—tied to Bitcoin’s price movement.

Leadership and Legacy

In 2022, Michael Saylor stepped down as CEO to become Executive Chairman, focusing exclusively on the company’s Bitcoin strategy and evangelism. Phong Le, a long-time executive, took over as CEO, managing the day-to-day software business.

MicroStrategy’s evolution has made it a unique hybrid in the capital markets: a company whose value proposition is a blend of technology, treasury management, and macroeconomic speculation. Its Bitcoin holdings, worth tens of billions at peak prices, have made the company a favorite among crypto bulls, while its bold treasury strategy has drawn praise and criticism in equal measure.

Impact and Outlook

MicroStrategy’s approach has influenced other companies to consider Bitcoin as a corporate reserve asset. The company’s capital raises—using debt to fund crypto purchases—have been closely watched by Wall Street. Investors in (NASDAQ:MSTR) are now essentially betting on two businesses: a stable, cash-generating BI software arm, and a high-risk, high-reward Bitcoin holding company.

As the landscape for both business intelligence and digital assets continues to evolve, MicroStrategy stands as a testament to the power—and peril—of bold corporate bets. The company’s history is a case study in how strategic pivots can redefine an enterprise, for better or worse.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any security. Investing in cryptocurrencies and related stocks involves significant risks. Always conduct your own research or consult a qualified financial advisor before making investment decisions.